https://www.borntosell.com/portfolio

http://www.888options.com/resources/covered_call_calculator.jsp

http://www.etfcoveredcalls.com/covered-call-walkthrough/

http://coveredwriter.blogspot.com/

http://www.mymoneyblog.com/

Covered Call Candidates:

QLD, SQQQ

TQQQ -- SQQQ

QQQ -- QID,

XLK, IYZ

Monday, March 28, 2011

Sunday, March 27, 2011

US Equity History YTD (1st Quarter)

US Equity History YTD (1st Quarter) along with major events:

Japan ETF -- EWJ

=======================================

Five Myths About Asset Allocation

Richard A. Ferri, 06.11.10, 11:00 AM EDT

Forbes Magazine dated June 28, 2010

There is no perfect allocation and no absolute protection in a bear market. But it's still worth diversifying and rebalancing once a year.

Myth 1: Asset allocation protects you from the bear.

Myth 2: Tactical allocation is best in volatile markets.

Myth 3: There is an optimal strategic asset allocation.

Myth 4: Constant rebalancing is needed.

Myth 5: More funds equals more diversification.

========================================

http://www.bloomberg.com/markets/economic-calendar/

http://www.etfsecurities.com/us/securities/etfs_securities.asp

Perfect Portfolios: Updated

http://www.smartmoney.com/investing/stocks/the-perfect-portfolio-1294688341486/

http://online.wsj.com/public/quotes/browse_etfs.html

http://blogs.barrons.com/focusonfunds/?mod=BOL_other_tnav_blogs

Japan ETF -- EWJ

=======================================

Five Myths About Asset Allocation

Richard A. Ferri, 06.11.10, 11:00 AM EDT

Forbes Magazine dated June 28, 2010

There is no perfect allocation and no absolute protection in a bear market. But it's still worth diversifying and rebalancing once a year.

Myth 1: Asset allocation protects you from the bear.

Myth 2: Tactical allocation is best in volatile markets.

Myth 3: There is an optimal strategic asset allocation.

Myth 4: Constant rebalancing is needed.

Myth 5: More funds equals more diversification.

========================================

http://www.bloomberg.com/markets/economic-calendar/

http://www.etfsecurities.com/us/securities/etfs_securities.asp

Perfect Portfolios: Updated

http://www.smartmoney.com/investing/stocks/the-perfect-portfolio-1294688341486/

http://online.wsj.com/public/quotes/browse_etfs.html

http://blogs.barrons.com/focusonfunds/?mod=BOL_other_tnav_blogs

Expected Retirement Account Acrument

| Current fund Amount: $260,000.00 | ||

|---|---|---|

| Total fund Amount: | $1,377,230.04 | |

| Interest: | 6% | |

| Annual contribution: | $24,000.00 | |

| Age to reach your goal: | 65 | |

| Fund Values for the Next 17 Years | ||

|---|---|---|

| Year | Total Annual Contribution | Total Fund Value |

| 1 | 24,000.00 | 299,600.00 |

| 2 | 48,000.00 | 341,576.00 |

| 3 | 72,000.00 | 386,070.56 |

| 4 | 96,000.00 | 433,234.79 |

| 5 | 120,000.00 | 483,228.88 |

| 6 | 144,000.00 | 536,222.61 |

| 7 | 168,000.00 | 592,395.97 |

| 8 | 192,000.00 | 651,939.73 |

| 9 | 216,000.00 | 715,056.11 |

| 10 | 240,000.00 | 781,959.48 |

| 11 | 264,000.00 | 852,877.05 |

| 12 | 288,000.00 | 928,049.67 |

| 13 | 312,000.00 | 1,007,732.65 |

| 14 | 336,000.00 | 1,092,196.61 |

| 15 | 360,000.00 | 1,181,728.41 |

| 16 | 384,000.00 | 1,276,632.11 |

| 17 | 408,000.00 | 1,377,230.04 |

©2011 Bloomberg L.P. All rights reserved.

Friday, March 25, 2011

First Covered Call in 2011

1. Look at the 1 Yr Stock Chart for QLD. It looks like a chance to do covered call -- It has fallen from its Feburary high and started to rebound. Optimistically, there is chance it will bounce back to its Feburary high of $95.35. The stock is not at around $89. From $89 to $95, it is of ($95-$89)/$89=6.7% increase.

2. Take a look at the Option Chain for option expiring on July 16. The bid and ask prices of the $89 call are $7.3 and $7.8 respectively. Conservatively, there is possibility of maximum return of $7.3/$89=8.2% within about 4 months.

3.To calculate the "Premium" of the "Net Debit",

Premium = Bid Price of the Underlying Stock - Ask Price of the Call Option

= $89.23 - $7.85 + $0.05 = $81.38 + $0.05 = $81.43

Here is the order:

Here is the Review of the Order before submission:

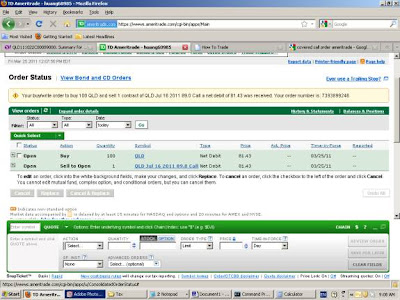

4. Here is the Order Status before its being filled:

5. Here is the Order Status when it is filled:

Here is the History page after the order is filled:

Price bought = $88.94

Premium received = $7.51

Total Cost = $88.94 * 100 + 20 = 8910$

----------------------------------------

Balance Before Covered Call Trading:

Cash balance $0.00

Money market $10,841.80

Long stock value $3,386.56 (QLD= 89.12$/share * 38 shares)

------------------------------------------------------------------------

Account value $14,228.36

Balance After Covered Call Trading:

Cash balance $0.00

Money market $2688.04 $10,841.80-$8143-$10.76

Long stock value $12,273.72 (QLD= 88.17$/share * 138 shares)

Short Stock Value -$750 ($7.5 * 100 = $750)

------------------------------------------------------------

Account value $14,105.5

Cash balance $0.00

Money market $10,841.80

Long stock value $3,386.56 (QLD= 89.12$/share * 38 shares)

------------------------------------------------------------------------

Account value $14,228.36

Balance After Covered Call Trading:

Cash balance $0.00

Money market $2688.04 $10,841.80-$8143-$10.76

Long stock value $12,273.72 (QLD= 88.17$/share * 138 shares)

Short Stock Value -$750 ($7.5 * 100 = $750)

------------------------------------------------------------

Account value $14,105.5

7. Let's see what we will get as maximum possible gain and loss:

7.1 Maxium Possible Gain:

Final Banlance = ($88.94+$7.51)x100 = $96.45x100 = $9645

Total Rate of Return (TRR) = ($9645-$8910)/$8910 = 8.24%

Final Balance = 138x$96.45 + $2688.04 - $11 = $15,987.14

7.2 "Reasonable" Possible Loss:

Final Balance = ($70+$7.51)x100 = $77.51x100 = $7751

Total Rate of Return (TRR) = ($7751-$8910)/$8910$

= -$1159/$8910 = -13.00%

If this happens, I will buy $750 worth of QLD, that will be

$750/($70/share) = 10 shares.

Final Balance = 138x$70.00 + $2688.04 = $12,348.04.

Let's see if we will end up at $15,987.14 or $12,348.04. Most likely it will be at somewhere in between.

Here is the QLD option quote expiring July 16, 2011:

http://finance.yahoo.com/q/os?s=QLD&m=2011-07-15

Here is the QLD option quote expiring July 16, 2011:

http://finance.yahoo.com/q/os?s=QLD&m=2011-07-15

8. Prediction of Best and Worst Cases in 5 Years:

Best Case:

4 Months: 8%;

12 Months: 1.08^3 = 1.259 ==> 25.9% anually

5 Yrs: 1.2^5 = 2.488

$14,000 ==> $8910 x 2.48 = $34,832 in 5 years.

Worst Case:

The stock will go to $30/share

10 shares bought whenever it drops 20$, so, 30 shares to be bought

Total Values (38+100+30)shares * 30$/share + $2500 cash

= $5040+ $2500=$7540.

TRR = (7540-14,000) / 14,000 = -6460/14000 = -46%

However, it reaches to $70, the portfolio will become:

168*70$ + 2500$ = 11,760$ + 2500$ = 14,260$

Subscribe to:

Comments (Atom)